Beginner’s Guide – Cryptocurrency & Bitcoin

Are you curious about cryptocurrency and Bitcoin but confused by the jargon? You’re not alone. Many beginners feel the same way.

This simple guide breaks down the basics in clear and easy language. As a result, you’ll understand how digital currencies work without stress. Whether you’re just exploring or planning your first investment, this guide gives you the foundation to start with confidence.

Let’s start by demystifying the notion of ‘White Label Casinos,‘ a term that has been gaining popularity in the world of online gambling.

White Label Casinos—also known as “turnkey” or “skin” casinos—offer a streamlined path for aspiring operators to launch their own branded online casino without building one from the ground up. By leveraging pre-built infrastructure and cutting-edge technology, these platforms provide a fast, cost-effective entry into the highly competitive iGaming market.

However, this convenience comes with its own set of challenges, as operators must navigate regulatory hurdles, ensure adherence to industry standards, and compete in a crowded marketplace. Now, let’s shift our focus to the fascinating world of cryptocurrencies, a digital medium of exchange that uses cryptography to secure transactions, control the creation of new units, and verify the transfer of assets.

What Is Cryptocurrency?

Cryptocurrency is a digital medium of exchange that uses cryptographic techniques to secure transactions, control the creation of new units, and verify asset transfers. Unlike traditional fiat currencies issued by central banks, cryptocurrencies are decentralized and operate on a peer-to-peer network, offering greater transparency, security, and autonomy.

A Quick Look at Bitcoin

Bitcoin—the first and most recognized cryptocurrency—was introduced in 2009 by an anonymous figure or group known as Satoshi Nakamoto. Designed as a decentralized alternative to traditional currency, Bitcoin paved the way for thousands of altcoins (alternative cryptocurrencies), each offering unique functionalities and purposes.

Understanding the Core Concepts

Navigating the world of cryptocurrency might seem intimidating at first, but breaking down the essentials makes it far more approachable:

-

Blockchain: The foundational technology behind all cryptocurrencies. A decentralized ledger that records all transactions across a network.

-

Wallets: Digital tools used to store, send, and receive cryptocurrencies. Wallets come in various forms—hot (online) and cold (offline)—depending on your security needs.

-

Mining: The process by which new coins are created and transactions are validated. Miners use computing power to solve complex algorithms and add blocks to the blockchain.

-

Altcoins: Any cryptocurrency other than Bitcoin, such as Ethereum, Litecoin, or Solana, each with different features and use cases.

Whether you’re a curious newcomer or a savvy investor looking to diversify your portfolio, this Beginner’s Guide to Cryptocurrency and Bitcoin will equip you with the knowledge and tools to navigate the dynamic world of digital assets confidently.

So, grab a cup of coffee, sit back, and prepare to embark on a journey into the future of money.

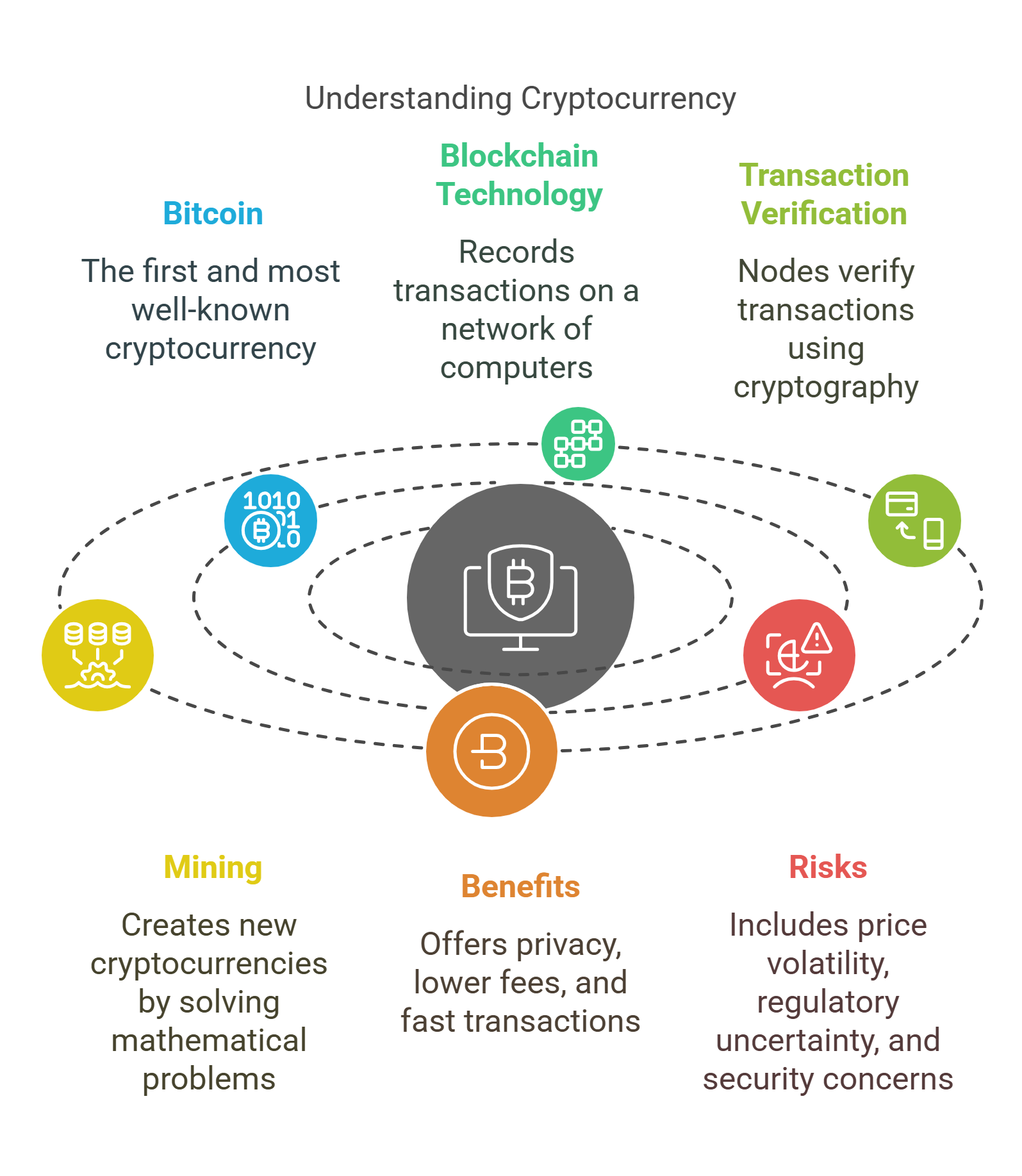

Introduction to Cryptocurrency

Cryptocurrency is digital money that uses cryptography for secure transactions. Bitcoin is the first and most well-known cryptocurrency, operating on blockchain technology. This technology records transactions on a network of computers. Network nodes verify transactions using cryptography and add them to the blockchain for transparency and security. Cryptocurrencies are not issued by a central authority but rely on a network of nodes to validate transactions. Mining creates new cryptocurrencies by solving mathematical problems to maintain network integrity. Cryptocurrencies offer benefits like privacy, lower fees, and fast transactions. However, there are risks such as price volatility, regulation uncertainty, and security concerns. Despite challenges, cryptocurrency’s future looks promising as it transforms finance and technology.

What is Bitcoin?

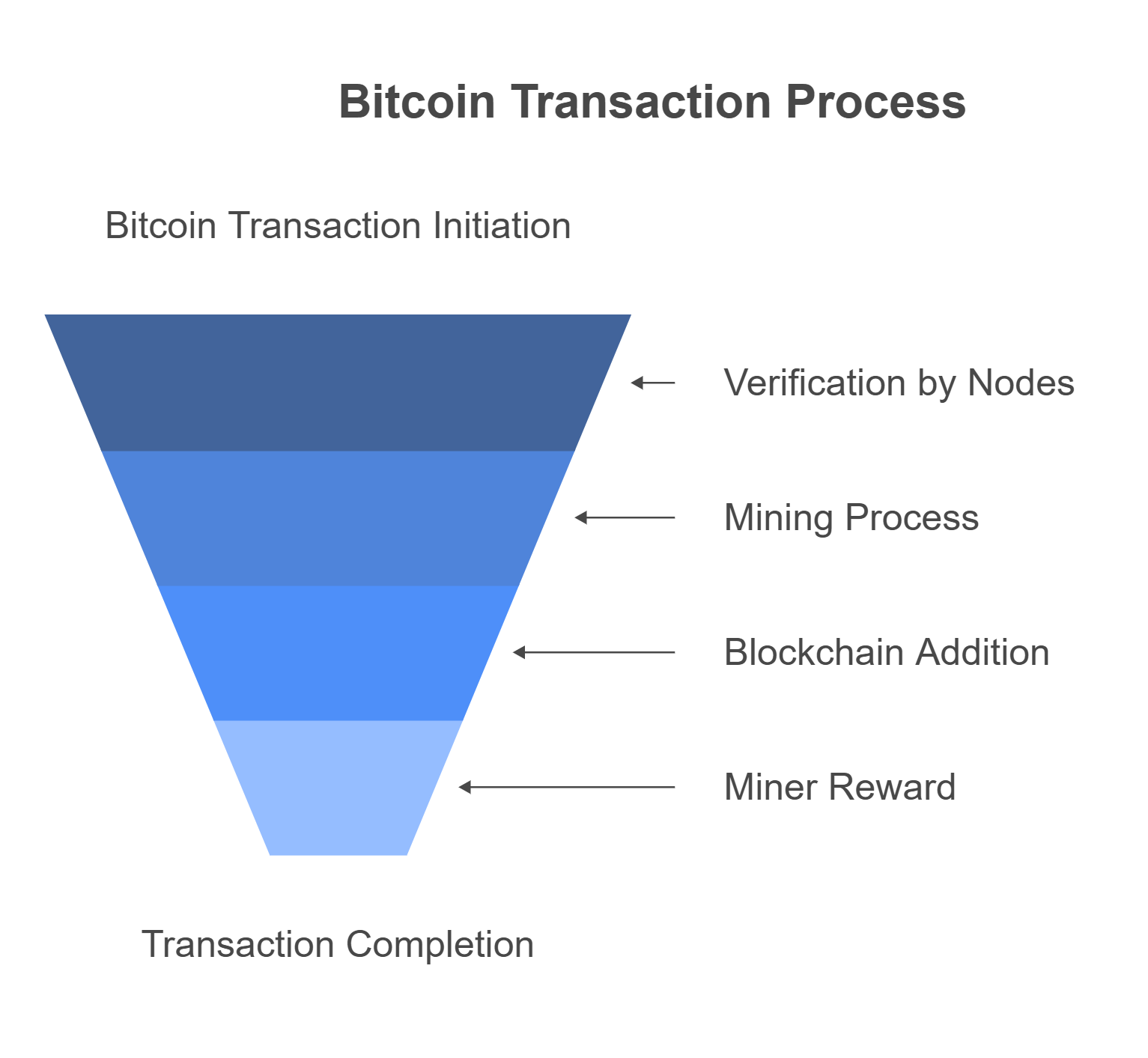

When a Bitcoin transaction occurs, network nodes verify it through mining. In this process, miners solve complex math puzzles to add the transaction to the blockchain. Miners earn new bitcoins and transaction fees as rewards for securing the network.

With a fixed limit of 21 million bitcoins, scarcity is guaranteed. As a result, Bitcoin maintains long-term value. Transactions are also pseudonymous. Instead of personal information, they use unique wallet addresses, which provide a layer of privacy.

Moreover, Bitcoin is decentralized. No government or single entity controls it. This independence makes the network resistant to censorship and outside interference. In addition, Bitcoin attracts people who want freedom from traditional banking systems.

As a digital currency, Bitcoin can move across borders within minutes. Low fees make it especially useful for payments and remittances worldwide.

Although Bitcoin’s price can be volatile due to market demand, its technology and principles continue to drive innovation and adoption in the financial industry.

Blockchain Technology Explained

In short, a blockchain is a digital ledger that stores a chain of blocks with transaction data. Each block is linked to the previous one through cryptography, creating a transparent record of all network transactions.

One important aspect of blockchain technology is its decentralized nature. Instead of a central authority, blockchain networks rely on peer-to-peer validation. Transactions are verified by nodes across the globe, ensuring transparency and security. Cryptographic techniques enhance privacy and prevent tampering. Overall, blockchain technology transforms how we store and transfer value by offering a secure and efficient system for direct transactions between individuals.

How Cryptocurrency Transactions Work

When a cryptocurrency transaction starts, it is sent to a network of nodes. These nodes check the transaction against past blockchain records. Once most nodes agree, the transaction is added to a block and becomes part of the blockchain.

Strong cryptographic algorithms protect each transaction, making changes nearly impossible. This ensures every record is secure and permanent. As a result, the system removes the need for banks or other intermediaries. Transactions are faster and often cheaper.

Moreover, cryptocurrency is decentralized. No single entity controls the process. This design makes transactions resistant to censorship and manipulation.

Mining and Cryptocurrency Creation

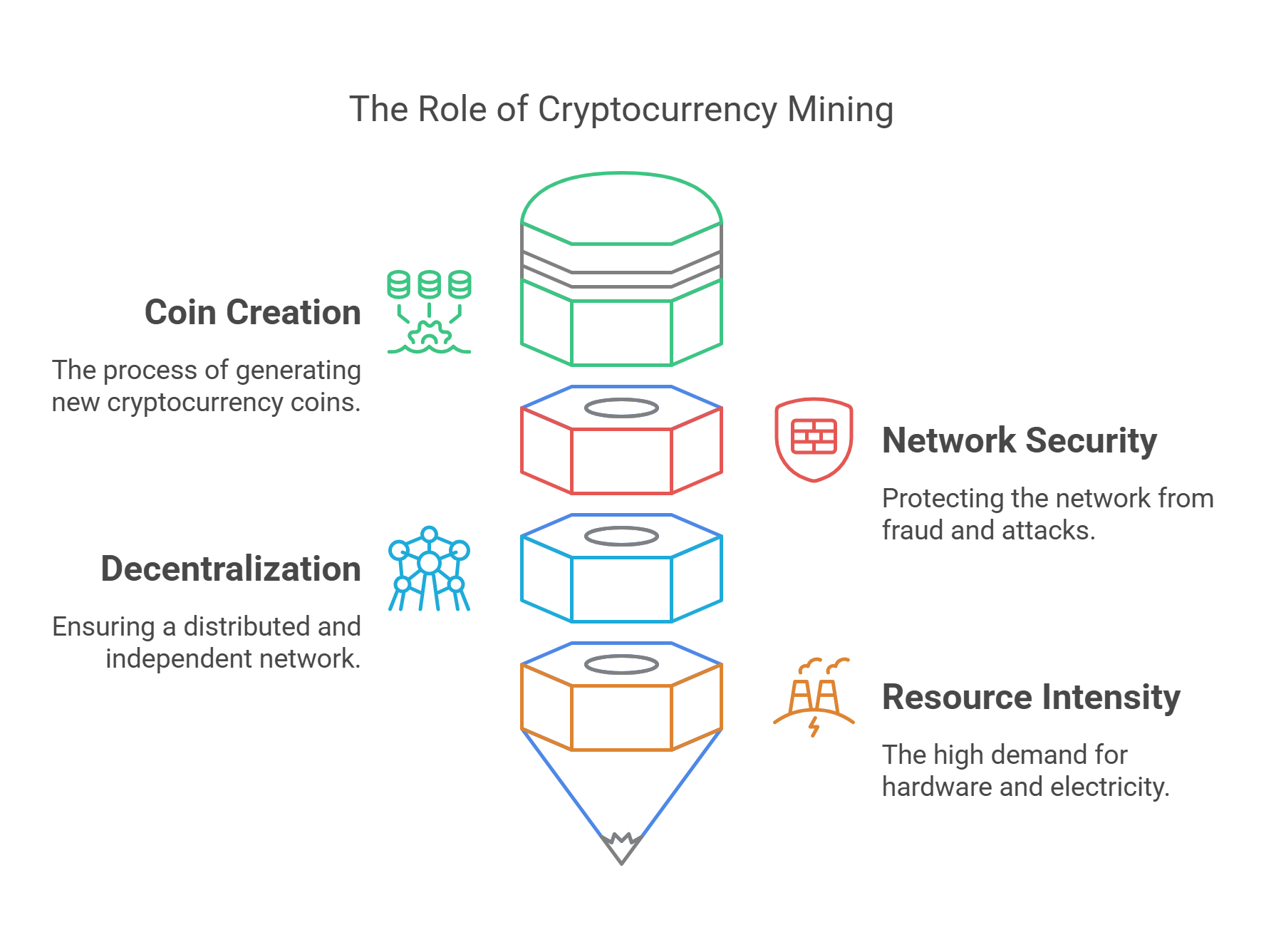

Miners use powerful computers to solve math problems and validate transactions. When they succeed, a new block is added to the blockchain. As a reward, miners receive newly created cryptocurrency coins.

This process prevents double-spending and protects the network. As a result, it maintains both security and transparency. Mining is also crucial for creating new coins and stopping fraud.

Moreover, miners ensure the decentralized nature of cryptocurrencies. They process transactions and secure the network against attacks. While mining is competitive and resource-intensive, it remains essential for the success of digital currencies like Bitcoin.

The Future of Mining

As cryptocurrencies like Bitcoin gain popularity, mining remains vital for their operation. It promotes innovation in technology and methods, as miners continually seek more efficient ways to validate transactions and create new coins.

The ongoing evolution of mining practices reflects the dynamic nature of the cryptocurrency landscape. This highlights its importance in safeguarding digital transactions and maintaining the trust of users in the system.

Benefits of Using Cryptocurrency

Cryptocurrencies are revolutionizing the way people interact with money, offering a wide range of advantages over traditional financial systems. According to a report by Blockchain.com, one of the most significant benefits is the security and immutability of transactions. Thanks to blockchain technology, every transaction is recorded on a decentralized ledger that is virtually tamper-proof, making fraud and unauthorized changes nearly impossible.

Another key advantage lies in the decentralized nature of cryptocurrencies, which gives users greater control over their funds and enhances financial privacy. Unlike traditional banking systems that rely on centralized intermediaries, cryptocurrencies allow individuals to manage their assets independently, without third-party oversight or restrictions.

Cryptocurrencies also enable fast and cost-efficient international transactions. Users can transfer funds across borders in a matter of minutes, often with minimal fees—eliminating the delays and high costs typically associated with banks and other financial institutions. This makes cryptocurrencies a practical solution for global commerce, remittances, and cross-border payments.

Empowering Financial Inclusion

Beyond convenience and efficiency, cryptocurrencies offer a path to greater financial inclusion. In many parts of the world, access to traditional banking remains limited or nonexistent. Cryptocurrencies address this gap by enabling anyone with an internet connection to participate in the digital economy. No bank account or credit history is required—just a smartphone or computer.

This borderless accessibility has the potential to empower underserved populations, support economic development in underbanked regions, and foster financial innovation where it’s needed most. By removing traditional barriers and leveraging decentralized networks, cryptocurrencies are reshaping the financial landscape and driving the transition toward a more inclusive global economy.

Risks and Security Concerns

While cryptocurrencies offer numerous advantages, they also come with a unique set of risks that investors must carefully consider. One of the most notable is price volatility—cryptocurrency values can fluctuate dramatically within short periods, potentially leading to significant financial losses. This unpredictability makes the market attractive to traders but risky for unprepared or inexperienced investors.

Another major concern is the lack of comprehensive regulation across the industry. In many jurisdictions, regulatory frameworks for cryptocurrencies are still evolving, creating opportunities for fraudulent schemes and scams to flourish. Without proper oversight, investors may find it difficult to seek recourse if they fall victim to malicious actors or deceptive platforms.

Security is also a critical issue.Unlike bank accounts, cryptocurrency is stored in digital wallets. These wallets face risks from hacking, phishing, and cyberattacks. Once compromised, funds are almost impossible to recover.

As such, strong security practices are essential. Investors should enable two-factor authentication (2FA) and use trusted wallets. In addition, hardware wallets provide extra protection. Moreover, staying alert to suspicious activity helps safeguard your assets.

Effectively managing these risks requires due diligence, education, and a proactive approach to cybersecurity. Understanding both the rewards and potential pitfalls of cryptocurrency investment is key to navigating this high-risk, high-reward financial landscape.

Future Outlook for Cryptocurrency

When choosing a new phone, consider factors like camera quality, battery life, and processing speed. Think about how you’ll use the phone daily and what features matter most to you. Reading reviews can also help. The best phone depends on your preferences and needs.

Embracing Cryptocurrency: How DSTGAMING is Leading the Revolution in Online Gaming Transactions

Cryptocurrency and Bitcoin have taken the world by storm. They promise decentralized, secure, and anonymous transactions. But what exactly are they, and how do they work?

Imagine a financial system where banks are replaced by a global peer-to-peer network. Each user holds a unique digital wallet. This is the world of cryptocurrency.

Cryptocurrencies are digital assets that use cryptography to secure transactions and create new units. Bitcoin, the first and most famous cryptocurrency, was launched in 2009 by the mysterious Satoshi Nakamoto. At its core lies the blockchain—a transparent, decentralized ledger that records every transaction.

Unlike traditional currencies controlled by banks and governments, Bitcoin runs on a distributed network. As a result, it offers transparency, independence, and fewer middlemen.

Where DSTGAMING Fits In

DSTGAMING, a leading White Label Casino Gaming Provider, empowers businesses to integrate cryptocurrency payment systems into their online platforms. By enabling Bitcoin and other crypto transactions, operators can offer players secure, fast, and anonymous payment options—a growing demand in today’s digital economy.

With DSTGAMING robust technology and industry expertise, businesses can capitalize on the expanding adoption of cryptocurrencies, delivering a seamless and modern gaming experience. Whether you’re an established operator or a new entrant in the iGaming space, DSTGAMING provides the tools and infrastructure to help you succeed in this new era of digital finance.

All in All

Cryptocurrency and Bitcoin have become buzzwords in the world of finance, sparking both excitement and confusion among investors and consumers alike. In its simplest form, cryptocurrency is a digital form of currency that relies on encryption techniques to regulate the creation of units and to verify the transfer of funds.

Bitcoin, the first and most famous cryptocurrency, was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin operates on a decentralized network known as blockchain, which serves as a digital ledger of all transactions made with the currency.

The true appeal of cryptocurrency comes from its decentralized structure. It operates free from control by any single government or institution. This independence has earned both praise and criticism.

For some, it represents a powerful shift toward financial freedom and personal empowerment. However, others see risks in volatility, misuse, and limited regulation.

The crypto market is famous for price swings. Yet many investors are drawn to its high-reward potential. Beyond that, cryptocurrencies like Bitcoin are reshaping payments, money transfers, and cross-border transactions where traditional systems often fail.

As new coins and blockchain projects emerge, the future of digital currency remains uncertain. Even so, it holds undeniable promise. Whether you are an experienced investor or a curious beginner, cryptocurrency invites exploration—and opportunity.

In this new era of finance, one thing is clear: Bitcoin and cryptocurrency are no longer fringe ideas. They are changing how we view value, ownership, and the global economy. Embrace the change, stay informed, and be open to the future of digital finance.

The future is uncertain, but one thing is for sure – cryptocurrency is a force to be reckoned with.