KYC in Gaming – What It Is and Why It Matters

In the last few years, online gaming has evolved very quickly. As this market grows, so do worries about fraud, security, and compliance. To keep both players and operators safe, Know Your Customer (KYC) protocols are increasingly very important.

In this article, we’ll explain what KYC in gaming is and why it matters. We’ll also talk about how DSTGAMING, a leader in online casino software, helps keep the casino platforms secure and compliant with global regulations.

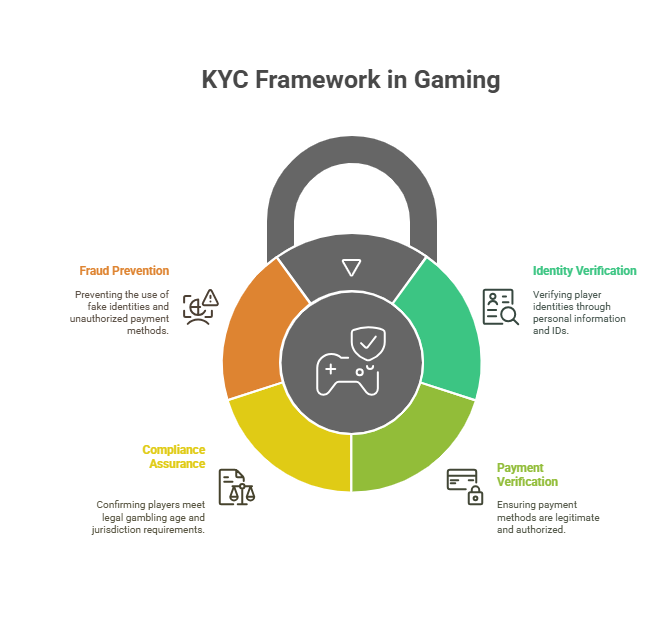

What is KYC in Gaming?

Know Your Customer (KYC) is a standard process to verify the identity of people who use a platform. In gaming, it implies getting personal information like a player’s full name, date of birth, address, and valid ID. Operators also need to verify the payment methods to make sure that the user is the legitimate account holder.

This approach helps operators make sure that players are who they say they are. It stops people from utilizing fake IDs or payment methods that aren’t allowed by the platform. It also ensures that gamers can legally gamble based on their age and jurisdiction.

As part of our white label and turnkey solutions at DSTGAMING, we support operators by providing them with built-in KYC features. Such tools are supposed to simplify verification and minimize the chance of fraud while making sure every user is in compliance by the time they first log in.

How KYC Works in Online Gaming

In the case of online gaming, the KYC process begins with user registration. The players are also required to enter basic information, such as their full name, date of birth, and residential address, as well as their phone number. This initial step allows the platform to obtain the data it requires so as to initiate the verification process.

Once signed up, the users are requested to provide valid identification documents. You can use a government-issued ID, passport, national ID card, or driver’s license. The platform then uses this data to confirm that the identity corresponds to that of the user. This plays a great role in the verification of the age and nationality of the player.

You will also need to provide proof of your address. This can be submitted as a recent utility bill, bank statement or government correspondence. Verifying the address assists the operators in complying with geographical restrictions and ensures the user is not located in a prohibited region.

Certain users, especially those who deposit or withdraw large sums, will be required to perform additional procedures referred to as Enhanced Due Diligence (EDD). When that happens, operators may request documents to prove sources of funds. Such evidence may come in the form of pay slips, bank statements or other evidence of legitimate income. EDD plays an essential role in complying with anti-money laundering (AML) rules and preventing funds misuse.

The automated KYC system from DSTGAMING helps with the entire process. With our integrated solutions, operators can quickly and easily carry out compliant identity checks without ruining the user experience.

Why Gaming Operators Must Implement KYC

Fraud and criminal activities happen a lot on online gaming sites. Because transactions involve real money, they usually attract people with evil motives. In the absence of KYC, there is a possibility of criminals exploiting stolen identities, stealing money through chargeback fraud, or laundering money through several fake accounts.

KYC allows operators to prevent these risks by verifying the identity of the users before they place a deposit, make a withdrawal, and even play. It also guarantees that no underage and unauthorized locations have access to any gambling material. This process protects the platform and ensures it is on the same page with the law in all jurisdictions.

There are people who prefer using no-KYC casinos because they are able to create an account faster and do not need to deal with so many identity verifications. However, such platforms often operate in legal gray areas, and they are far more prone to fraudulent activities, fines from regulatory authorities, and reputational damage.

DSTGAMING does not endorse such shortcuts, and that is why it assists operators to establish safe KYC flows that are compliant and simple to use. Our risk management tools enable gaming businesses to screen customers early, comply with regulations, and run their operations with long-term confidence.

Benefits and Functions of KYC in Gaming

The following are the benefits and functions of KYC in gaming.

Preventing Fraud and Money Laundering

One of the main reasons KYC exists in gaming is to stop fraud. Criminals can use stolen identities to open fake accounts or perform chargeback fraud. By checking the legitimacy of user data, KYC procedures make it difficult for these things to happen.

Money laundering is also on the increase. The Financial Action Task Force (FATF) requires gambling platforms to follow strict Anti-Money Laundering (AML) rules.

DSTGAMING supports these measures with advanced risk management tools that detect suspicious transactions early.

Ensuring Regulatory Compliance

The majority of countries now have gambling laws that require KYC verification. Failure to obey these laws may frequently result in the imposition of fines, license cancellation, or even criminal prosecutions.

As an example, the UK Gambling Commission states that an operator has to check a user’s age and identity before they can gamble. The new Brazilian regulations under Law 14.790/2023 set some of the strictest KYC requirements in the world.

DSTGAMING solutions are designed to work with operators in many different locations and adapt to both local and international requirements.

Preventing Underage Gambling

One of the main purposes of KYC is to stop kids from gambling. It is both legal and ethical to check people’s ages. Operators can prevent kids from getting access by verifying their government-issued ID and date of birth.

Promoting Responsible Gambling

KYC also supports responsible gaming. Operators can detect patterns of problem gambling by verifying users and analyzing how they spend their money. For self-exclusion tools and deposit limits to work, user profiles need to be accurate. These tools won’t work well without proper KYC.

DSTGAMING has these kinds of features in its CRM and responsible gaming modules, which gives operators the chance to act early.

Protecting User Data

In KYC, data security is very important. Operators store sensitive user documents, which makes them a target for hackers. To keep you safe, DSTGAMING enforces end-to-end encryption and strict access control. It also helps operators follow compliance regulations like GDPR. Keeping data safe makes users trust the company and protects it from penalties due to data leaks.

Verifying Payment Methods and Source of Funds

Another thing that KYC does is verify payment information. This guarantees that users do not use fake accounts or stolen cards. There are also cases when operators may require confirmation of the fund source by a user in cases of a large transaction or a customer in a high-risk area. DSTGAMING integrates safe verification of payment and source of funds checks, which minimizes the risk of fraud and violating regulations.

Continuous Monitoring and Risk Detection

Even after onboarding, KYC does not stop, as operators keep monitoring the users to identify red flags. Alerts may go off if gamers’ betting behavior becomes unusual, they’re based in high-risk countries, or they make quick deposits and withdrawals. DSTGAMING has AI-powered monitoring tools that help operators find these problems early on.

KYC and Crypto Casinos

Cryptocurrency’s emergence in online gaming has introduced both new opportunities and new challenges. Players are using crypto payments more and more since they are fast and easy to use across borders. However, the fact that blockchain transactions are anonymous makes crypto appealing to people who want to go around standard financial checks.

Regulators and gaming operators have a big concern over this anonymity. In the absence of KYC, crypto casinos will be easy prey when it comes to money laundering, fraud, and other financial crimes. Digital wallets may hide the identity of criminals, so it is difficult to determine the source of money or identify suspicious patterns.

In order to manage such risks, regulators are making crypto-based gaming companies adopt the same KYC and Anti-Money Laundering (AML) requirements as their fiat counterparts. These include verifying full identity, checking documents, verifying the source of funds and monitoring ongoing transactions. Compliance is no longer an option, especially for decentralized payment systems.

DSTGAMING supports these requirements with its crypto casino solutions. With built-in KYC modules and blockchain transaction tracking capabilities, our systems allow operators to know everything about the identity of the user and the source of their funds. This guarantees the safety of crypto payments, their ability to become tracked, and compliance with international regulations.

Handling KYC Across Global Markets

Online gaming platforms usually serve a global clientele. This implies that operators will be required to comply with numerous KYC rules that vary in every country. Every nation has its regulations regarding the verification of a person’s identity, their age, the type of documents required and how long the platform can keep data. Some are stricter on their anti-money laundering (AML) regulations, while others have an especially tight form of privacy legislation, such as the EU General Data Protection Regulation (GDPR).

DSTGAMING makes this process easier by including a compliance framework that works across multiple jurisdictions on its platform. Our systems are made to understand and adapt to local obligations, like age limits for users in the UK, checks on the source of funds in Brazil, and the U.S. Bank Secrecy Act’s requirement to monitor transactions.

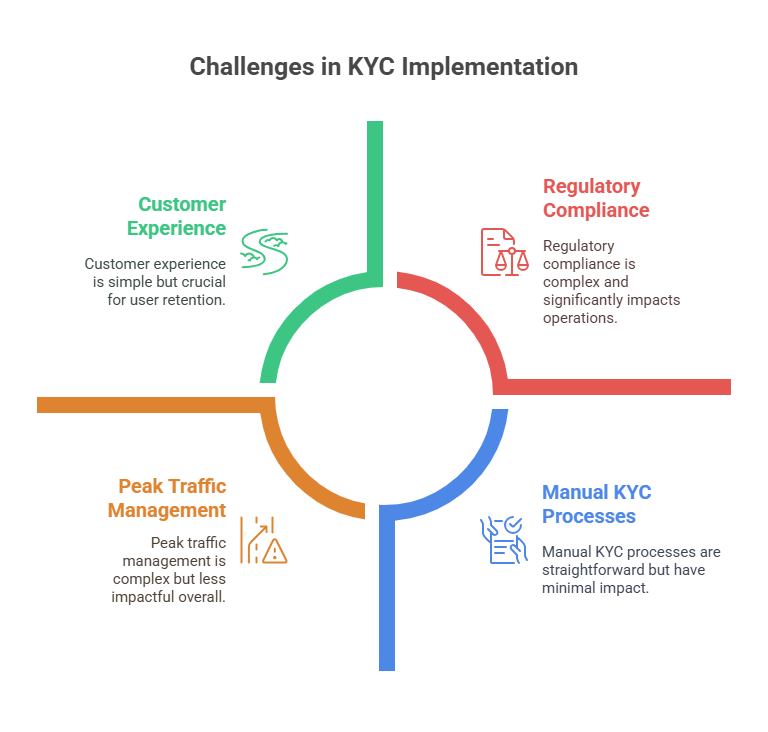

Challenges in KYC Implementation

Safe and legal gaming depends on proper KYC, which is not always easy to implement. Among the most problematic issues is the necessity to maintain a smooth customer experience in addition to meeting the high standards of compliance. The time-consuming or complex verification may get irritating to first-timers, especially when creating their accounts. The users will abandon the platform if the process is too difficult or takes too long to complete.

Another significant challenge is the high peak traffic. User activity can increase during promotions, tournaments, or other special events. This sudden rise can be too much for systems that rely primarily on manual KYC processes. If there are verification bottlenecks, they might slow down the onboarding process and make customers unhappy.

It’s harder for gaming companies that operate in more than one jurisdiction. This is because there are different laws for identity checks, document requirements, and data protection in each region. For small businesses, it might be hard to keep up with these local regulations. A mistake or delay can lead to penalties or legal action.

DSTGAMING fixes these problems with very scalable and API-ready systems that can handle both normal traffic and peak load. These tools make the process faster, cut down on waiting times, and help operators stay compliant without making things harder for users.

Conclusion

KYC is not only a legal requirement; it is also a key aspect of secure and responsible gambling. Gaming companies need to take identity verification seriously to stop fraud, keep gamers safe, and comply with regulations.

DSTGAMING helps platforms set up good KYC processes, which makes gaming safer and helps the global iGaming business be successful for a long time. Gaming companies can protect their future by making compliance a top priority today.