Social Casino Trends to Watch in 2025

Social casinos stick to one rule, and it’s not up for debate: players spend virtual coins, and there’s no cash-out option. That fact shapes everything—how ads get cleared, the way store pages are worded, the age ratings, and even the notes given to creators in 2025. Skip it, and you’re asking for trouble. Keep it visible everywhere: “virtual currency only, no real-world prizes.”

DSTGAMING role is to streamline setup so teams can move faster. The Turnkey Online Casino Solutions provide a ready-to-launch stack, Casino Payment Solutions support stable processing during peak periods, and the Casino Game Aggregator simplifies rolling out fresh live-ops content without heavy logistics.

If someone on the team still needs a baseline, point them to What is iGaming? and The Rise of Social Casinos. Those two explain the basics, nail down the right language, and get everyone aligned. After that, the sections below walk through what’s changing now, with links and clear steps you can put to work right away.

The Line That Defines Social Casino Gets Sharper

Per Google Play’s content ratings, social casino falls under “simulated gambling.” No winnings. No cash-out. Cross that threshold and issues begin—ads are in review, store approvals lag, creator content is blocked. Do this: use the same wording everywhere. Ads. Store pages. Tutorials. Help articles. The exact line’s in Google Ads: Gambling & Games.

Transactions do count too. A bumbling checkout and players depart. DSTGAMING maintains coin purchases constant, regardless of traffic increases. Pay, coins materialize—quick, no hassle.

To teams working through UX, payments, or support, refer to Must-Have Features for an Online Casino and Turnkey vs. White Label before cementing plans.

Personalized UA Returns for Social-Casino App Campaigns

Google Ads again allows personalized targeting for social-casino App campaigns in eligible regions, provided creatives clearly state “no real-world prizes” and comply with local laws. See Google Ads Gambling & Games policy and policy-update coverage.

Creator Policies to Watch

YouTube policy restricts content that links to unapproved gambling sites and may apply age gates or removals. Twitch’s update continues to block streams of unlicensed slots, roulette, or dice. Creator briefs should remove risky links, keep disclosures clear, and use visuals that never imply cash-out.

UA Team Quick Actions

- Keep “no real-world prizes” in every ad and store page; mirror policy wording for faster approvals.

- Track certifications and approved geos in one shared sheet; review before each new burst.

- Enforce a creator-brief checklist for YouTube/Twitch: approved links only, clear disclosures, no logos or mentions of unapproved operators.

Creative and Messaging That Works

Short videos that show a clean value moment tend to convert best: a jackpot animation, a bonus-room entry, or a club milestone that unlocks a perk. Clear overlays beat hype—statements like “virtual coins only” and “no cash-out” remove confusion and keep comments positive. For teams building landing pages, Online Casino Industry: Expert Strategies offers layout patterns that carry the same promise from ad to store to in-game tutorial.

Android Billing and Distribution Keep Moving

Two clocks define the year. On July 31, 2025, the U.S. Ninth Circuit upheld the Epic v. Google verdict and affirmed a three-year injunction; on August 1, the court granted a temporary pause to review implementation steps. Expect staged changes toward more choice rather than an overnight flip; operators should follow official court and Play notices, not rumor threads.

Developer Deadlines That Still Apply

Google’s timeline stands: Play Billing Library v7 (or newer) is required for all new apps and updates by August 31, 2025, with a one-time extension to November 1, 2025. Teams on v5/6 should schedule migration and test proration, restores, refunds, and promo entitlements.

Android Checklist for Product Leads

- Book the PBL v7 upgrade. Then test everything—buys, proration, restore, promos—from tap to receipt. No gaps.

- Pick one owner to watch the Epic/Google filings. Change nothing until the official updates drop. Full stop.

- Keep help pages current; during engineering work, rely on Casino Payment Solutions for stable purchase options and clear receipts.

Testing Matrix and Rollback Plan

Migrations go easier with a basic matrix: current build against v7 build. Run it across fresh installs, upgrades, and restores. Check the basics first—single-item buys, bulk orders, subscriptions if they’re part of the mix. Then run through promo codes, entitlements, and refunds. And don’t skip a rollback drill. The team should know how to push a hotfix without scrambling receipts.

First week after launch, monitor chargebacks and payment declines. A sudden jump often means SKUs don’t match, cache is stuck, or store regions don’t line up. Support can usually clear it fast with the right set of steps.

Where DSTGAMING Fits: the player path remains steady—region-correct store credit → redeem once → buy in-app—while distribution and billing policies evolve in phases.

Rewarded Video Grows Up

Roblox introduced full-screen rewarded video via Google Ad Manager and shared early results: average completion above 80%, with some experiences crossing 90%. Those numbers show that value-for-time still works when rewards remain clear and modest; support content appears in Roblox Ads Help and trade coverage such as AdExchanger.

Placement and pacing decide results. Top-of-session placements help new users feel progress, while post-loss placements recover momentum without pushing oversized rewards. Measure holdouts and session length, not clicks; holdout tests and session-length deltas give a cleaner read than click-through alone. DSTGAMING’s Gamification Solutions align quests and limited-time perks so rewarded video complements, rather than cannibalizes, top-selling bundles.

Live-Ops, VIP, and Direct-to-Consumer Push Deeper Spend

Earnings show long-term players spend heavily. Light & Wonder / SciPlay told investors revenue hit about $821M in 2024, with direct-to-consumer share close to 11%—and higher margins there.

DoubleDown Interactive said payers were spending in the high $270s to low $280s each month late 2024 into early 2025.

That usually means tight event schedules, VIP care that feels personal, and offers that match what people are ready to spend.

Operationally, growth comes from steady content and easy payments. The Casino Game Aggregator adds new games quickly—perfect for themed rooms, seasonal runs, all that.

Casino Payment Solutions keep VIP bundles and promos flowing, with payment options that don’t slow things down.

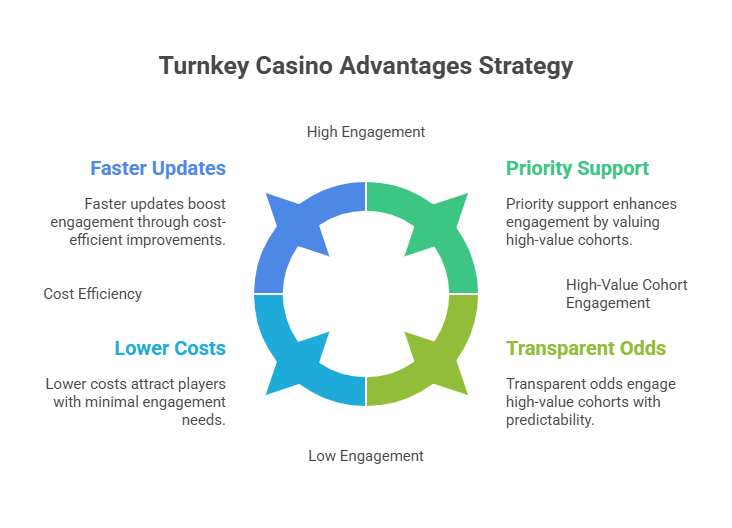

In the big slides for leadership, Turnkey Casino Advantages lays it out—one stack, lower costs, faster updates. Design notes that help? That’s what makes it stick. Limited-time leaderboards and club races generate social pressure without fake scarcity; fair pity timers and soft caps keep events from spiking volatility. High-value cohorts respond to privilege and predictability—priority support, early access to rooms, and transparent odds where applicable.

Age Ratings and Regional Rules Get Stricter

Apple’s age-rating definitions map Frequent/Intense Simulated Gambling to 17+. Australia’s 2024 changes classify simulated gambling as R18+ and paid loot boxes as M; Google Play relies on IARC with regional overlays that can raise labels based on descriptors. Teams shipping across markets should draft for the strictest scenario and keep statements consistent.

What Players and Families Should See

- Clear language on store pages and in-app help: “virtual currency only, no real-world prizes.”

- Links to built-in controls: Play budget and order history on Android; Screen Time on iOS.

- A short “spend smart” explainer in help content that reflects platform rules and local guidance.

Rules differ by region. The IARC questionnaire can shift results based on descriptors like “simulated gambling” vs. “frequent simulated gambling,” so product and legal should own those answers, not leave them to chance at submission. Store copy, screenshots, and ad creative should all repeat the same promise; mixed messages create appeal risk and slow reviews.

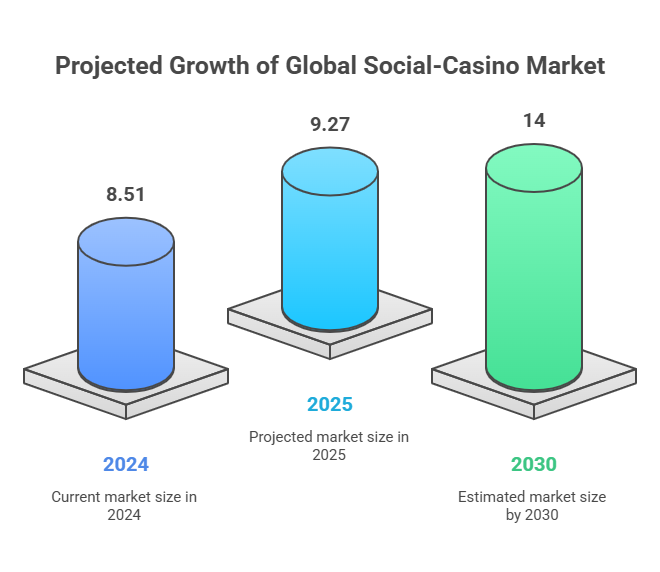

The Global Market Keeps Climbing

Market research places the global social-casino category at $8.51B in 2024 with a projected 8.9% CAGR through 2030, implying roughly $9.27B in 2025 and a path toward ~$14B by 2030. A high-level reference appears in Grand View Research coverage of social casino; treat the figures as a planning backdrop rather than license to relax guardrails.

Planning assumptions should stay grounded. Forecasts are not quotas; UA budgets still depend on creative supply, store placement, and regional payment success rates. Teams that model LTV with generous tails should also model churn shocks after policy changes or device migrations. A conservative posture—tight frequency caps, honest copy, and measured offer cadence—usually sustains revenue longer than hard sprints.

DSTGAMING platform scales with that arc. Game Aggregators – Blog explains single-API content expansion; the product page covers integration paths. For multi-brand references, the portfolio shows live builds and design patterns.

Privacy-First Attribution on Android Reshapes Measurement

Android’s Privacy Sandbox shifts measurement from user-level signals to aggregated reports. The Attribution Reporting API introduces event and summary reporting that avoids cross-app identifiers while still counting installs and post-install actions. Teams should run parallel tests, compare windows and deduping, and set clear thresholds for “good” under the new rules.

Reporting changes more than ad concepts. Ad teams using Google Surfaces should pair ARA testing with official integration notes to prevent reporting drift during launches. Stable purchasing helps here—steady rails keep attribution shifts from turning into support tickets. Data hygiene matters as well; consistent campaign naming, clean source tags, and aligned conversion schemas cut noise and speed decision-making.

DSTGAMING guidance remains direct: match the gift-card region to the player’s store account, redeem to that account, and purchase coins in-app. That habit keeps spending predictably while attribution evolves behind the scenes.

Buyer Safety Climbs the Agenda

Gift cards and prepaid codes remain common fraud vectors. The U.S. FTC’s guidance on gift-card scams highlights the pattern: pressure, urgency, and a push to pay fees or “verify” accounts with cards. Safer behavior remains straightforward—purchase from trusted sellers, never share codes in chat, and redeem inside the account immediately. Suspicious demands should be reported to the platform and to consumer authorities.

Account security reinforces these habits. Enabling Google 2-Step Verification or Apple ID two-factor authentication helps keep redemptions tied to the right owner, and receipts should always reflect the signed-in account. Clean wording on emails and checkout pages reduces confusion that scammers exploit.

DSTGAMING reduces friction at checkout with clear receipts, consistent wording, and a direct path from payment to redemption. The loop avoids risky detours that often appear in social DMs or unofficial marketplaces.

Account Portability and Cross-Device Play Become Standard

Players switch between devices and expect coins, progress, and VIP status to follow without friction. Clean account binding and restore flows prevent purchases from landing on guest profiles. Strong flows prompt sign-in before checkout, display the active account, and send receipts that match what appears in-game.

Portability pairs well with seasonal content drops. A player who upgrades a phone and immediately finds new rooms, missions, and jackpots is more likely to resume daily sessions. The Casino Game Aggregator helps keep that promise by refreshing catalogs with minimal engineering time and aligning releases with live-ops calendars.

DSTGAMING’s advice stays consistent: purchase region-correct credit, redeem into the right store account, and buy coins while signed in. This habit cuts lost purchases, reduces support contacts, and preserves VIP perks.

Conclusion

In 2025, the rule stays the same: virtual currency, for fun, with no real-world prizes. Google restored personalization for social-casino App campaigns, but copy still needs to match policy lines. YouTube tightened linking rules, Twitch maintains restrictions on unlicensed gambling content, and Android billing advances with Play Billing Library v7 deadlines while longer-term distribution changes arrive in stages.

Rewarded video proves its value at platform scale. Ratings and regional rules remain strict. The global market keeps rising, and privacy-first attribution reshapes reporting. Success in this environment comes from clarity and discipline: consistent “no real-world prizes” statements, predictable purchasing, careful creator briefs, privacy-aware measurement, and visible buyer-safety tips.

DSTGAMING toolkit—Turnkey Online Casino for fast setup, Casino Payment Solutions for smooth rails, Casino Game Aggregator for constant content, plus the supporting blogs linked above—aligns to that plan so teams can ship on time and keep players focused on play.

Ready to take the next step in your iGaming journey? Contact DSTGAMING today to learn more about our comprehensive solutions and how they can support your business growth.