Turnkey Provider Mistakes Cost MILLIONS!

Pick the wrong turnkey casino provider and you don’t just lose time—you burn bankroll, delay launch, and box your brand into a platform you’ll outgrow. Pick right and you go live fast, stay compliant, and scale without re-platforming. DSTGAMING sees both stories every week: ambitious operators with sharp brands, and deals that quietly hide missing licenses, thin game portfolios, and weak payments.

This guide cuts through the noise. You’ll see the most common mistakes—price over product fit, ignoring KYC/AML, shallow aggregation, fragile payments, weak CRM, poor data, and no long-term support—and how to avoid them. No fluff. Clear checkpoints you can take to any vendor call.

Why listen to us? DSTGAMING builds and ships turnkey online casino solutions, so we know where projects stall and where margins leak. We’ve watched strong concepts fail for simple reasons: unclear jurisdiction strategy, patchwork integrations, or a “fix it later” approach to fraud and retention. You don’t need that pain.

By the end, you’ll know what to ask, what to verify, and what to walk away from. And if you want a provider that treats launch as the start—not the peak—DSTGAMING aligns tech, compliance, content, and payments to support growth from day one via our Turnkey Online Casino Solution and Casino Payment Solutions.

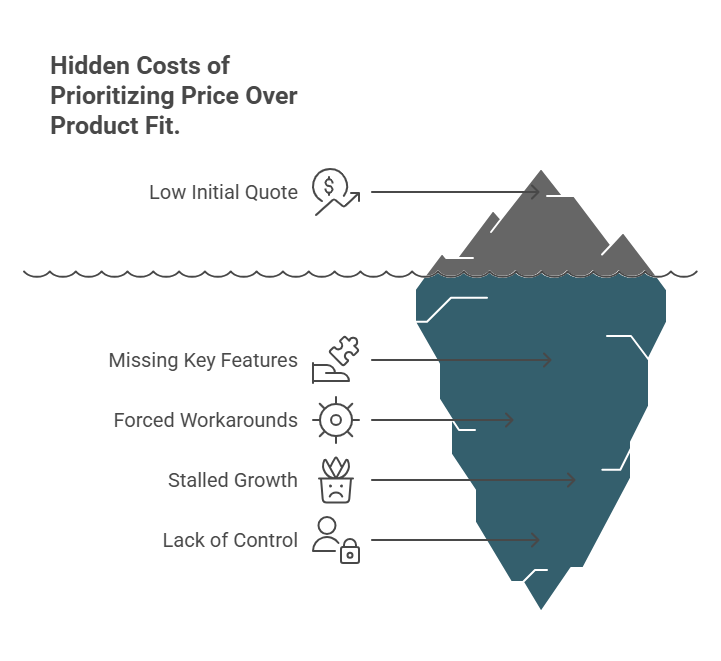

Mistake #1: Choosing Price Over Product Fit

What it looks like

Teams compare quotes, grab the lowest, and hope missing pieces won’t matter. Then launch day arrives and key parts aren’t there—license guidance, a real CRM, reporting, or the game suppliers your market expects. The “cheapest” option turns costly fast. For a reality check, skim our own playbook on fast, full-stack launches in How to Start Your Online Casino with a Turnkey Solution—it shows how corners cut early become delays later.

Why it hurts

Mismatched platforms force workarounds: custom dev for basics, slow third-party integrations, and blind spots in data. Growth stalls because the stack can’t support your roadmap. If you need end-to-end control from day one, compare ownership models in Turnkey vs White Label Casino before you commit; the differences matter for cost, compliance, and speed.

Quick checks to avoid it

- List must-have capabilities by market: licenses, KYC/AML flows, supported PSPs/APMs, content partners, BI dashboards, and CRM triggers.

- Ask for a live demo of back office: segmentation, bonus engine, risk tools, and regulatory reporting.

- Confirm who owns the roadmap and how often releases ship.

- Validate upgrade paths: can you add new jurisdictions, games, and wallets without re-platforming?

How DSTGAMING handles it

We scope fit before we price. Our Turnkey Online Casino Solution ships with licensing guidance, multi-currency/multi-language, bonus and CRM tooling, and ongoing updates—so you aren’t patching basics post-contract.

Mistake #2: Ignoring licensing, KYC/AML, and security

What it looks like

Teams rush to sign, then scramble over licenses, player verification, and data controls. The result: delayed go-live, PSP rejections, and angry partners. If you’re eyeing regulated markets, you need a mapped path on day one—jurisdictions, policies, and evidence.

Why it hurts

Regulators and payment providers expect airtight checks. Weak KYC or AML triggers failed audits, frozen funds, or exits from markets. In crypto or high-risk regions, the bar rises again. You’ll pay for the same work twice: first to patch, then to rebuild correctly.

Quick checks to avoid it

- Define your market plan up front (e.g., UKGC, MGA, Ontario, or .com with Curacao) and list required controls per jurisdiction.

- Verify the KYC flow: document collection, liveness checks, PEP/sanctions screening, proof-of-funds, and enhanced due diligence for high-risk players.

- Confirm transaction monitoring: velocity checks, device fingerprinting, self-exclusion sync, and chargeback playbooks.

- Ask for security practices: encryption at rest/in transit, role-based access, audit logs, and incident response.

- Check regulatory reporting: session data, affordability markers, AML SAR workflows, and game/RNG certificates with audit trails.

For a solid baseline, compare your requirements with the UK’s Remote Technical Standards (RTS) and security guidance—use them as a final check even if the UK isn’t your first launch.

How DSTGAMING handles it

We build compliance into the workflow. Our turnkey stack includes KYC/AML-ready flows, configurable risk rules, identity checks, and reporting aligned to major frameworks. If payments sit at the center of your model, pair the platform with Casino Payment Solutions to align PSP onboarding and monitoring from day one. For background on verification pressure points, see KYC in Gaming – What It Is and Why It Matters.

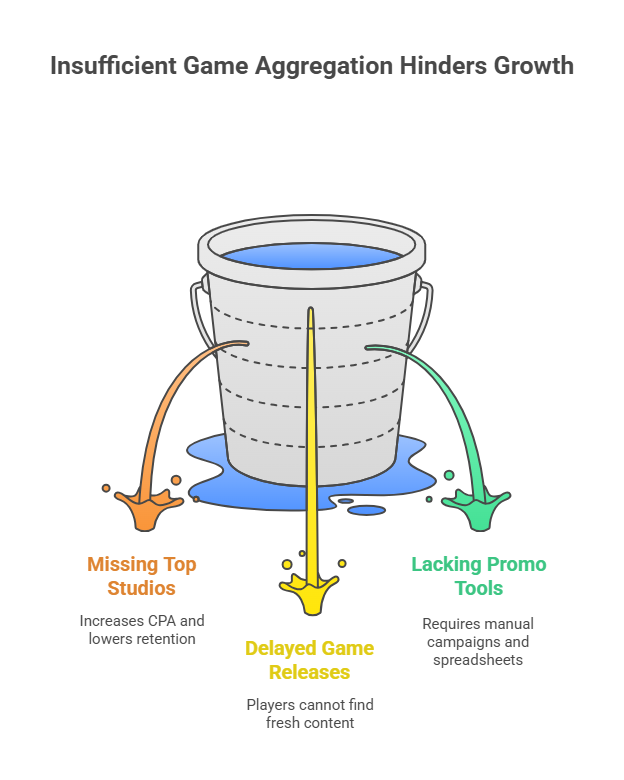

Mistake #3: Underestimating game aggregation depth

What it looks like

A provider waves a long “partners” list, but you can’t actually launch the studios your market wants, or you get them months later. Lobbies feel thin. Popular drops and tournaments aren’t available. Negotiations stall because the platform lacks the right aggregation rails.

Why it hurts

Content drives first deposits and repeat play. Miss the top studios for your region and your CPA climbs. Retention drops because players can’t find their favorites or fresh releases. Without native promo tools across providers, you end up running manual campaigns and bonus spreadsheets.

Quick checks to avoid it

- Ask for a live matrix of supported studios by jurisdiction, currency, and wallet type (fiat/crypto).

- Verify release cadence: how fast do new titles roll in after studio launch?

- Check promo tooling: network tournaments, free rounds, jackpots, drop campaigns, and how they track in back office.

- Confirm contracting: who signs the studio deals—you or the provider—and what reporting you get for reconciliation?

- Inspect lobby UX: categories, providers, RTP filters, hit-rate tags, and personalized carousels.

How DSTGAMING handles it

We handle the plumbing—contracts, reporting, and updates—so you can focus on acquisition and retention. If aggregation is a priority in your RFP, ask us to walk you through the studio matrix for your first two markets and your 90-day content plan.

Mistake #4: Overlooking payments, risk, and chargebacks

What it looks like

You sign the platform, then discover weak PSP coverage, poor risk rules, and no clear playbook for disputes. Cards decline, wallets fail KYC, and APMs don’t match your target markets. Chargebacks rise. Funds sit in review. Growth slows.

Why it hurts

Acquisition costs spike when first deposits fail. VIPs churn after one blocked payout. Without smart risk scoring and routing, you pay higher fees, lose fraud disputes, and trigger PSP reviews. Revenue becomes volatile because payment success depends on guesswork, not data.

Quick checks to avoid it

- Confirm PSP and APM coverage per country, currency, and wallet type (crypto/fiat).

- Ask for smart routing and retry logic: BIN-level rules, issuer fallbacks, and time-of-day retries.

- Review risk controls: velocity checks, device fingerprinting, behavioral flags, and case management.

- Inspect chargeback workflows: evidence packs, dispute SLAs, and win-rate tracking.

- Verify KYT/KYB for crypto flows and merchant onboarding so compliance and uptime don’t clash.

- Check payout ops: cutoff times, limits, and manual review queues.

How DSTGAMING handles it

We design payments as a growth lever. Casino Payment Solutions bundles PSP coverage, local APMs, crypto rails, and risk orchestration so you lift approval rates and cut fraud. We pair routing with data—issuer decline codes, cohort success by PSP, and chargeback analytics—so your team can tune acceptance without burning margin. Launching on the Turnkey Online Casino Solution keeps KYC, AML, and KYT rules aligned with risk settings, which stabilizes PSP relationships and payouts.

Mistake #5: Treating CRM and retention as an afterthought

What it looks like

Teams pour budget into acquisition, then run one-size-fits-all bonuses and blast emails to everyone. VIPs get bored. Casual players miss relevant offers. Churn climbs. LTV stalls because the CRM stack can’t segment, automate, or test.

Why it hurts

Acquisition gets pricier each month. If you don’t convert first deposits into second and third sessions, CAC never pays back. Weak lifecycle flows also inflate bonus burn and invite abuse. Without clear cohorts and A/B tests, you can’t prove what works—or fix what doesn’t.

Quick checks to avoid it

- Demand native segmentation by lifecycle stage, value, risk, payment method, and game preference.

- Check offer tooling: free rounds, reloads, missions, and time-boxed campaigns with caps and abuse guards.

- Verify automation: event-based triggers for FTD, reactivation, RTP slumps, and payout friction.

- Inspect testing: control groups, A/B, and holdout reporting.

- Review channels: on-site widgets, inbox, push, SMS/email, and personalized lobbies.

- Ask for KPIs in the back office: 7/30/90-day retention, NGR/LTV by cohort, and bonus ROI.

How DSTGAMING handles it

We ship retention tools with the platform so you can act on data, not hunches. Missions, quests, and campaign rules plug straight into segmentation for precise offers. And because CRM should link to payments and risk, lifecycle flows integrate with Casino Payment Solutions to nudge successful deposits, smooth KYC hurdles, and prevent churn at payout.

Mistake #6: Skipping data, reporting, and BI from day one

What it looks like

Dashboards look pretty but hide the signal. You can’t track cohorts, bonus ROI, PSP approval rates, or game-level margin. Finance fights with CSVs. Compliance reports take days. Decisions slow because no one trusts the numbers.

Why it hurts

You can’t tune acquisition or retention without clean data. Blind spots in PSP success, KYC friction, or game performance drain margin. Regulators and partners expect accurate, timely reports. If data is an afterthought, you rework the stack later—at higher cost and with production risk.

Quick checks to avoid it

- Ask for a single source of truth: player, session, payment, and game events joined by stable IDs.

- Confirm cohort reporting: FTD-to-second-deposit, 7/30/90-day retention, NGR/LTV by channel, PSP, and market.

- Verify bonus economics: breakage, abuse flags, and offer ROI with control groups.

- Inspect payments analytics: approval rates by BIN/issuer, decline code trends, chargeback win rate, payout SLAs.

- Check content analytics: RTP/hit-rate distributions, game mix by segment, release impact, and supplier share.

- Demand regulatory-ready exports: self-exclusion logs, AML/SAR workflows, game/RNG certificates, and audit trails.

- Ensure access: role-based views for execs, ops, CRM, risk, and finance; API/exports for BI tools.

How DSTGAMING handles it

We treat data as a product. DSTGAMING joins gameplay, wallet, and KYC events so your team can see the full customer journey. Cohort dashboards, bonus ROI, and PSP approval tracking come built in. Pair that with Turnkey Online Casino Solution and finance/legal get compliance exports and audit logs from day one.

Mistake #7: Treating launch as a one-off—no roadmap, no support

What it looks like

The deal ends at “go live.” There’s no release calendar, no SLA, and no named success owner. Bugs stack up. Studio add-ons slip. You spend more time chasing tickets than growing the business. Six months later, you’re debating a re-platform.

Why it hurts

iGaming moves fast—new studios, PSP policies, regulatory tweaks, device changes. Without a clear roadmap and support model, you fall behind on features, compliance, and payment acceptance. Every delay compounds CAC and churn.

Quick checks to avoid it

- Ask for a published roadmap: quarterly goals, upcoming studios, PSPs/APMs, CRM features, and compliance items.

- Confirm support structure: named CSM/solutions engineer, ticket priorities, response/resolve SLAs, and on-call coverage by timezone.

- Review release discipline: staging environment, rollback plan, change logs, and comms cadence.

- Verify scaling plan: new jurisdictions, new wallets (fiat/crypto), high-traffic events, and data archiving.

- Check commercials for change: what’s included vs. paid, and standard timelines so upgrades don’t stall.

How DSTGAMING handles it

We treat launch as the start of the partnership. Each operator gets a named success owner, an agreed release cadence, and a roadmap shaped around your markets and promos. On DSTGAMING, content drops, payment improvements, and compliance updates follow a schedule—so your team can plan campaigns with confidence.

How DSTGAMING helps you avoid these pitfalls (checklist)

Use this as a fast filter during vendor calls. It maps directly to our stack and process at DSTGAMING.

- Fit before price

- Scope markets, wallet types, and content needs first.

- See a live back-office demo (segmentation, bonus engine, risk, reporting).

- Confirm release cadence and upgrade paths.

- Anchor your build on the Turnkey Online Casino Solution to avoid patching basics later.

- Licensing, KYC/AML, security

- Map jurisdictions and controls up front (KYC tiers, PEP/sanctions, EDD, SAR workflow).

- Require encryption, RBAC, audit logs, and incident response.

- Align PSP onboarding and monitoring with Casino Payment Solutions.

- Game aggregation that actually launches

- Ask for a studio matrix by market/currency/wallet; verify promo tools and unified reporting.

- Lock a 90-day content plan before you sign.

- Payments, risk, chargebacks

- Demand PSP/APM coverage by country and BIN, smart routing, and retry logic.

- Review fraud rules, dispute playbooks, and payout SLAs.

- Track issuer-level success and adjust routing weekly.

- CRM and retention that pays back CAC

- Require segmentation, event triggers, and control groups.

- Tie offers to value, risk, and game preference; link lifecycle to payments to cut friction.

- Data and BI from day one

- Insist on a unified event model and cohort reporting.

- Export regulatory logs and finance reports on demand.

- Roadmap and support, not a hand-off

- Request roadmap, SLA, release notes, and a named success owner.

- Treat launch as the beginning, not the finish line.

Choose a Partner that Lifts Your Ceiling

Choosing a turnkey casino provider decides how far your brand can go. Scope the must-haves, test the back office live, and demand proof across compliance, aggregation, payments, CRM, and data. The market still has room to grow—independent research values online gambling at USD 78.66B in 2024 with a path to USD 153.57B by 2030—so the stack you pick now should support expansion, not block it.

Where DSTGAMING fits

If you want a provider that treats launch as the start of the job, DSTGAMING is built for that. Our Turnkey Online Casino Solution aligns licenses, content, and data from day one. Payments and risk plug in through Casino Payment Solutions, so approval rates and dispute wins improve instead of guessing.

Keep learning with DSTGAMING

- Weighing control vs. speed? Start with Turnkey vs White Label Casino and map responsibilities before you sign.

- Scoping onboarding and fraud controls? See KYC in Gaming – What It Is and Why It Matters for practical steps that reduce friction while meeting AML expectations.

Final word

Pick a platform that helps you launch fast and scale without re-platforming. If you want a team that pairs technology with clear roadmaps, SLAs, and measurable outcomes, talk to DSTGAMING. We’ll scope your markets, connect the right PSPs, and give your team the dashboards needed to grow with confidence.

Take the first step toward launching your iGaming brand today.

Book your free consultation now: DSTGAMING